Going into price negotiations without a lot of preliminary information mostly ends up in suboptimal results. This post is about structuring in the information in a decision tree stuffed with probabilities for the events. These probabilities are the result of market research.

The party with the most information has advantages in negotiations. They know the negotiation scope of the other side and th bargaining power do both sides. Other questios are: What do I want? How to avoid getting lost in bargaining? After looking into auctions, where for psychological reasons it is difficult to make rational decisions, I look at the decision tree with estimated earnings and probabilities.

Auctions – the risc of following the group

Auctions are popular for antiques, used items and real estate. In the bidding war the offers may run away while the auctionator counts highet and higher. This war requires at least two bidders. Participants see and hear competitors bid higher and higher and infect one another. The bidding continues, so the race goes on for not having a defeat. Giving up means the object is gone. Due to the short decision-making period and the group, spontaneous decisions are made, which be confirmed experimentally. As soon as the bid is accepted, the bidder goes back to his rational normal and recalculates: the high purchase price makes the investment unprofitable. The buyer tries to get out of the contract. This phenomenon occurs less often if a security deposit to be presented limits the bids.

How a decision tree helps

We try to look at every possible scenario and calculate the probability of that scenario. The example is about a freelance teacher, who applies for teaching a class. How much money will she get?

Sandra is applying to be a lecturer at the Montgomery Training Center. She has no experience and is pretty much broke right now, so she urgently needs paid work, her lower limit is 20 euros an hour. But she wants to achieve the maximum possible hourly rate in order to look good in front of her friends and colleagues and to earn money.

Sandra negotiantes with the dean, Ms. Dr. Teufel. She wants more earnings for the school and save money spent on teacher salaries. If teachers are scarce or one has special qualifications, she can pay up to 40 euros per hour. She tells the applicants that there are lecturers who work almost on a voluntary basis. So it tests their price scope downwards. That the training center also hires expensive lecturers is not for the appliants ears.

Doing background research helps

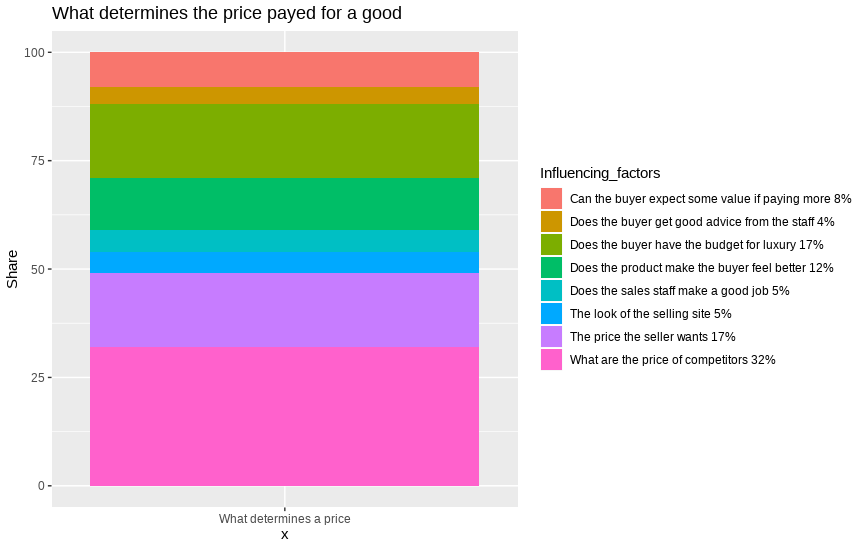

Sandra asks herself how much she could ask. She estimates that the school can spend up to 50% of the participiants fees for lecturers salaries[2] . The difficult question about the income of the training center can be answered with the help of price lists of the company, sales figures from the Federal Gazette (corporations have to publish there), inquired or estimated numbers of participants. Sandra does the math and comes to a maximum of 40 € per hour.

Sandra analyzes her competition. What is the likelihood that another qualified person will do it cheaper? This is very high when teaching in university cities. Public statistics on wage levels can help, or a survey among friends. Industry associations often have fee statistics. She heard from friends that they often only pay 25 euros per lesson. So what to do in the price negotiations?

Price Negotiations and Background Research: Add Probabilities to the decision tree and play with scenarios

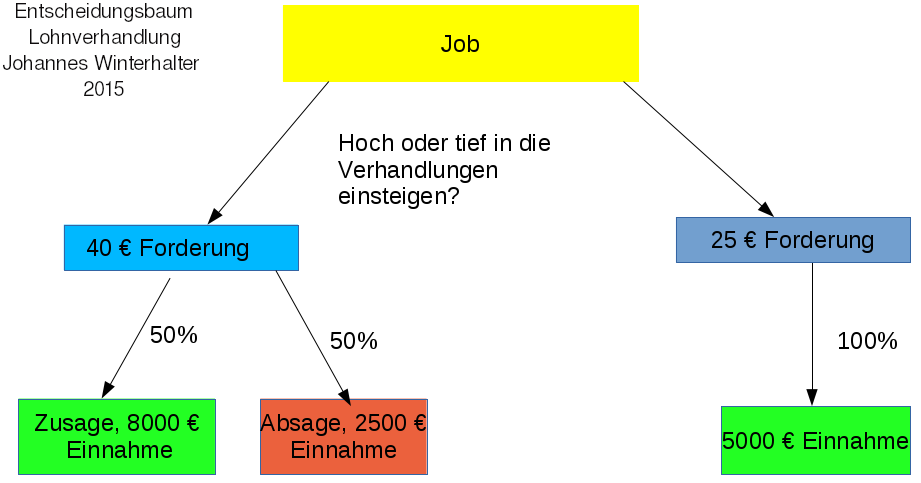

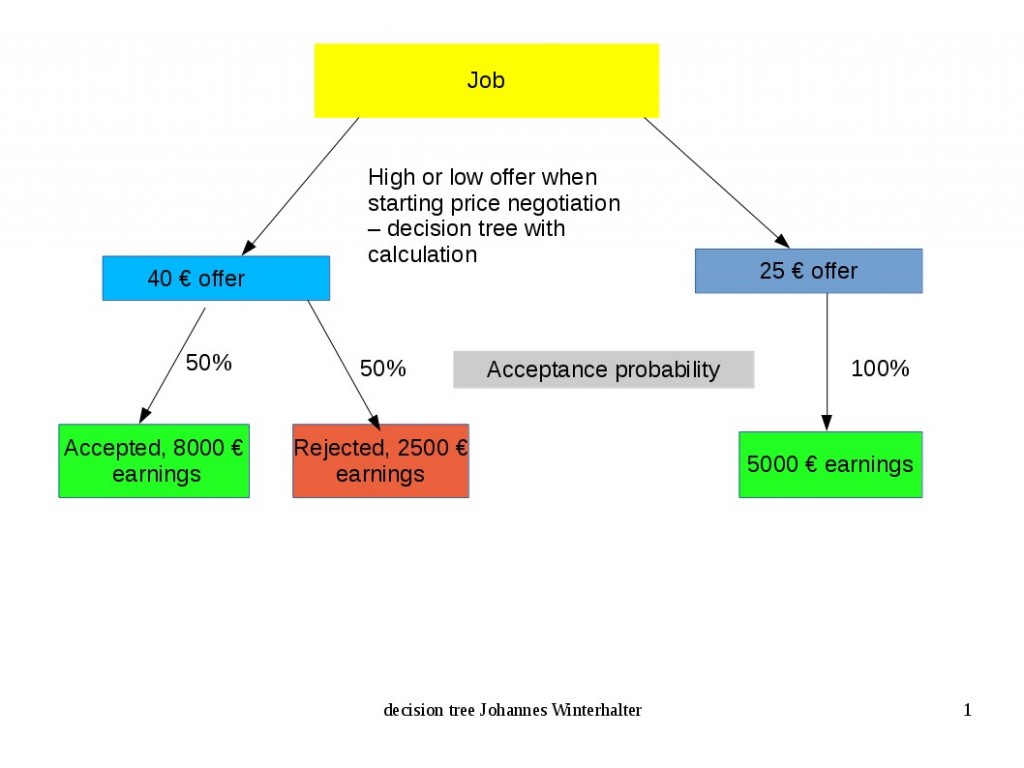

The probability that a sufficiently qualified applicant appears charging only charges 25 euros per hour is 50%. Let’s figure out whether Sandra should play it safe and demand 25 euros per hour or whether it is worth asking 40 euros per hour. The contract lasts for 200 hours, i.e. 5000 euros at 25 euros per hour and 8000 euros at 40 euros per hour.

Sandra realizes that she still doesn’t know enough about the lecturer market. What is the probability that in the case of a rejection by Dr. Teufel, a new job of the same type appears that brings in at least € 40 an hour? It is not possible to ask the competition, they will hardly tell the truth. Miss Dr. The devil is also talking about volunteering, so no wages at all.

Looking at the decision tree: if demanding 25 € per hour Sandra has the job safe and gets 5000 Euros. Demanding 40 € there is a 50% chance that she will earn 8000 Euro and 50% that she needs to go cleaning houses for 12,50 Euro each hour, that makes 2500 €. In addition and weighted by probability this goes to 5250 €, slightly more than talking about the low price.

External Factors – Prestige and Feeling Safe

Sandra possibly thinks she definitely needs the teaching job. She no longer wants to clean and needs references. Then she plays safe and only charges 25 € per hour. Demanding high prices is only worthwhile to a limited extent, as the previous analysis shows. The opportunity costs in the form of stressed nerves can be an argument for low claims.[3]

————————————————————–

- [2] To know this average value, information about the business model of the schools is necessary. The basis is the commercial calculation with cost price, handling costs – and profit surcharge and sales price. The lecturer’s fee is the cost price, the remuneration paid by the participants per lesson is the sales price. The trading surcharge includes rooms, advertising, administration and risk. [3]

- [3] Between 2008 to 2010 I did some tests with groups of 30 participants about that subject. The results were that very young people tend to ask too little money, older people tend to ask too much in price negotiations for work.